Daily Drop (1214)

12-31-25

Wednesday, Dec 31, 2025 // (IG): BB // GITHUB // SN R&D

China launches military drills around Taiwan

Bottom Line Up Front (BLUF): Silver prices plummeted nearly 9% on December 29, reversing a record-setting post-Christmas rally that had pushed the metal above $80 per ounce. The sharp decline—silver’s most significant single-day drop since the pandemic—was triggered by a combination of profit-taking and a CME announcement to raise margin requirements on metal futures. Gold also fell by more than 4%, underscoring the broader retreat in precious metals as speculative froth is shaken out.

Analyst Comments: When margin requirements go up, so do the exits—especially after parabolic gains. The move doesn’t necessarily signal a long-term reversal. Still, it’s a clear sign of how fragile momentum trades in metals can be when driven by macro narratives (rate cuts, currency debasement) rather than fundamentals. The broader concern is that speculative positioning in haven assets can destabilize pricing, especially when metals like silver also have industrial uses. Expect more volatility ahead as positioning adjusts and macro uncertainty continues into Q1.

READ THE STORY: FT

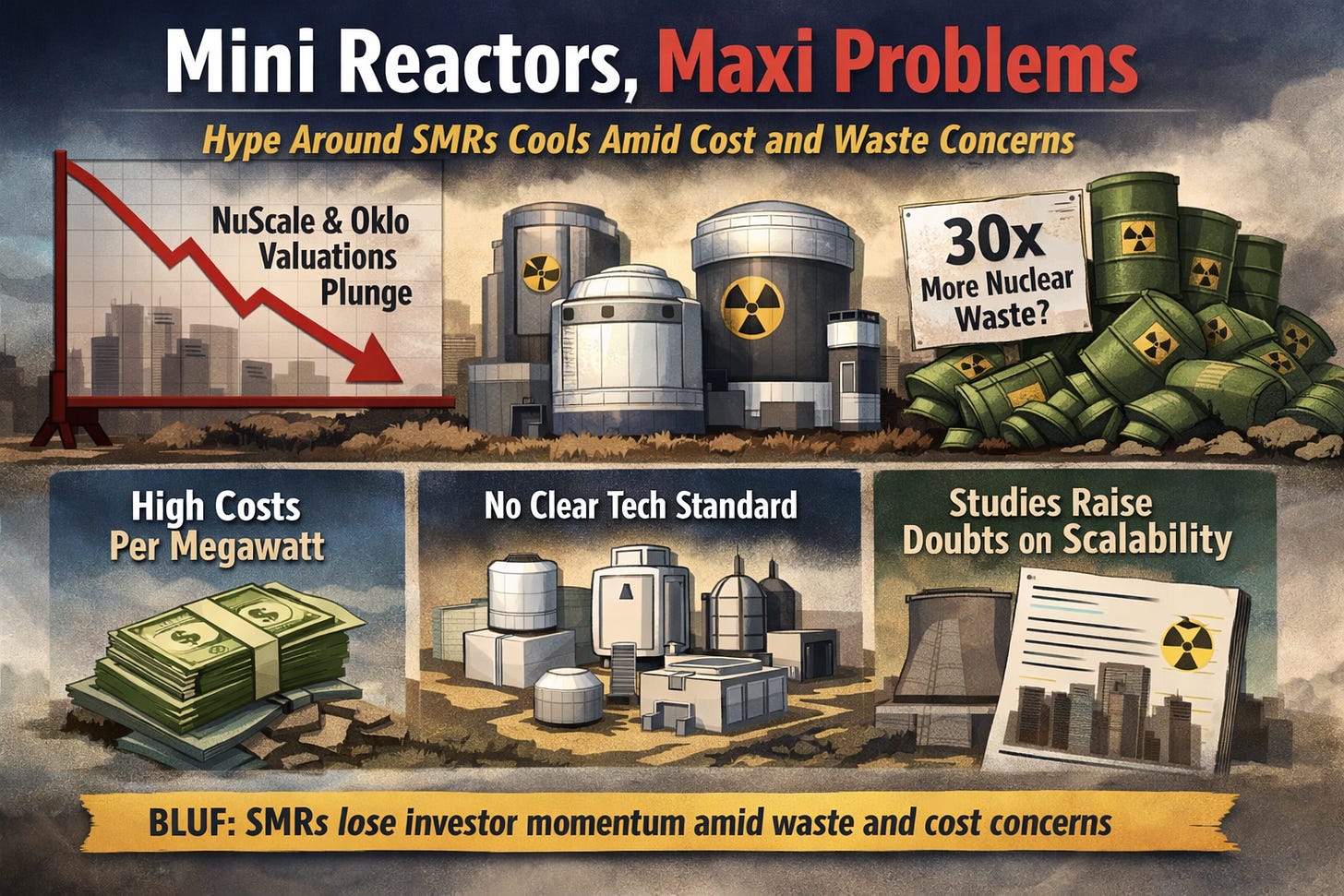

Mini Reactors, Maxi Problems: Hype Around SMRs Cools Amid Cost and Waste Concerns

Bottom Line Up Front (BLUF): Small modular nuclear reactors (SMRs) have lost investor momentum, with key developers such as NuScale and Oklo experiencing steep valuation declines. Despite support from governments and tech firms, multiple studies suggest that SMRs may generate significantly more nuclear waste than conventional reactors—potentially up to 30 times as much. Costs per megawatt remain higher, and no dominant technology standard has emerged, raising doubts about whether SMRs can scale as advertised.

Analyst Comments: The dream of factory-built, plug-and-play reactors powering data centers and remote grids is hitting hard technical and economic walls. While the concept of SMRs remains attractive—especially in regions with fragile grids or space constraints—the financial reality is sobering: higher cost per kilowatt, unresolved fuel-supply dependencies, and a nuclear-waste profile that’s more voluminous and complex. The waste findings are especially damaging. Early studies indicate that some SMR designs produce more short-lived, chemically reactive waste or require exotic fuels, complicating the back end of the fuel cycle. Without a clear winner among the 130+ competing SMR designs, investors are rightly skittish.

READ THE STORY: FT

Trump Signs Defense Bill Prohibiting China-Based Engineers in Pentagon IT Work

Bottom Line Up Front (BLUF): A new U.S. defense law bars engineers physically located in China from participating in Pentagon IT development, signaling a hard shift in federal supply chain policy. The move reflects concerns over foreign code provenance and escalates digital decoupling with China.

Analyst Comments: This isn’t about citizenship—it’s about jurisdiction. U.S. lawmakers are drawing geographic redlines for where defense code can be written. For defense contractors, this puts pressure on development workflows and offshoring practices, especially in AI, logistics software, and cloud integration. Expect this to influence adjacent sectors (e.g., healthcare, telecom) as the U.S. expands “clean code” requirements tied to national security.

READ MORE: ProPublica

China Moves to Regulate Anthropomorphic Robots

Bottom Line Up Front (BLUF): China is drafting new guidelines for humanoid robots, citing safety, data privacy, and alignment with “core socialist values.” The regulation aims to preempt risks as AI-integrated robots enter public and commercial life.

Analyst Comments: This isn’t just robotics policy—it’s strategic digital governance. Beijing is pre-emptively setting ideological and cybersecurity boundaries for next-gen automation, especially where AI intersects with surveillance and human interaction. Expect language controls, embedded censorship, and data tethering to domestic clouds. Western firms seeking access to China’s automation market will face compliance choke points.

READ MORE: InCyber

Nvidia Turns to TSMC to Meet China’s H200 Demand

Bottom Line Up Front (BLUF): Nvidia is quietly working with TSMC to produce and ship its China-specific H200 AI chips amid growing demand from sanctioned Chinese firms. The chips skirt U.S. export controls by limiting performance thresholds—but still enable generative AI training at scale.

Analyst Comments: This is tech diplomacy by fabrication. The U.S. is playing a game of thresholds, and China’s AI sector is adapting—fast. Nvidia’s custom silicon, tailored for export-compliant specs, still poses risks. Even neutered H200s can accelerate AI tools used in surveillance or military R&D. Expect Chinese APTs to reverse-engineer and combine chipsets, and to look for backchannel demand flowing through “friendly” states or shell firms.

READ MORE: The Register

China’s Next Decade: Alleged Tech Manufacturing Dominance by Design

Bottom Line Up Front (BLUF): New state-backed reports project China will consolidate its global lead in high-tech manufacturing through 2035. Prioritized sectors include semiconductors, AI, EVs, and aerospace, all supported by subsidies and decoupling strategies from Western supply chains.

Analyst Comments: China isn’t just making chips—it’s designing an ecosystem to withstand geopolitical disruption. The reports are a roadmap for tech-sector bifurcation: independent design standards, nationalized tooling, and internal software stacks. For cyber defenders, this means more “splinternet” risk: closed protocols, asymmetric bugs, and fewer shared baselines for vulnerability disclosure.

READ MORE: SCMP (CN)

Meta Acquires Chinese-Founded AI Agent Manus, Escalating US–China Tech Tensions

Bottom Line Up Front (BLUF): Meta has acquired Manus, a general-purpose AI agent platform with Chinese roots, in a deal that could become one of the company’s largest-ever AI acquisitions. The move bolsters Meta’s ambitions to build “personal superintelligence”. It signals growing U.S. tech interest in high-performance agentic systems—while simultaneously raising red flags in both Washington and Beijing amid rising geopolitical and regulatory scrutiny.

Analyst Comments: Manus is not only technically advanced but also geopolitically sensitive, having Chinese founders, U.S. investors (Benchmark), and a relocation to Singapore. With Meta aggressively pushing into agentic AI, the acquisition reflects a broader pivot toward autonomous, task-executing systems capable of code generation, market analysis, and enterprise automation. Expect congressional scrutiny in the U.S. and potential backlash in China, where the company’s founders are already being labeled as "defectors." The Manus purchase also raises strategic questions: Are U.S. tech giants now looking abroad to fill critical AI capability gaps? And how long before we see similar cross-border friction over AI agents as we’ve seen with semiconductors and surveillance tech?

READ THE STORY: FT

Iranian Rial Collapses Amid Sanctions, Inflation, and Public Unrest

Bottom Line Up Front (BLUF): Meta has acquired Manus, a general-purpose AI agent platform with Chinese roots, in a deal that could become one of the company’s largest-ever AI acquisitions. The move bolsters Meta’s ambitions to build “personal superintelligence”. It signals growing U.S. tech interest in high-performance agentic systems—while simultaneously raising red flags in both Washington and Beijing amid rising geopolitical and regulatory scrutiny.

Analyst Comments: Manus is not only technically advanced but also geopolitically sensitive, having Chinese founders, U.S. investors (Benchmark), and a relocation to Singapore. With Meta aggressively pushing into agentic AI, the acquisition reflects a broader pivot toward autonomous, task-executing systems capable of code generation, market analysis, and enterprise automation. Expect congressional scrutiny in the U.S. and potential backlash in China, where the company’s founders are already being labeled as “defectors.” The Manus purchase also raises strategic questions: Are U.S. tech giants now looking abroad to fill critical AI capability gaps? And how long before we see similar cross-border friction over AI agents as we’ve seen with semiconductors and surveillance tech?

READ THE STORY: FT

Items of interest

Functional Programming Gains Ground in Fortifying Critical Infrastructure Reliability

Bottom Line Up Front (BLUF): Organizations managing critical infrastructure are increasingly adopting functional programming (FP) to improve software reliability, reduce system failures, and harden security. A recent report from WebProNews outlines how principles such as immutability, stateless design, and deterministic execution are being used to prevent bugs and cascading failures across sectors including energy, telecommunications, and transportation.

Analyst Comments: Functional programming offers guarantees that are hard to match in traditional imperative codebases: no hidden state, fewer side effects, and more straightforward reasoning about behavior under stress. In mission-critical systems, that kind of predictability is gold. Adoption is still uneven—FP requires specialized expertise and can be overkill in some contexts—but its growing presence in sectors like intelligent grid control and telecom orchestration speaks volumes. With cyber-physical systems becoming more complex and interconnected, don’t be surprised if FP becomes a go-to choice for safety-critical code paths.

READ THE STORY: WPN

Fortifying Our Critical Infrastructure for a Digital World (Video)

FROM THE MEDIA: Phil Venables discussed the shift from security to resilience, the recommendations on cyber-physical resilience from the President’s Council of Advisors on Science and Technology (PCAST), and organizational responsibilities to help fortify resilience of critical infrastructure and services.

Fortifying critical infrastructure against global threats (Video)

FROM THE MEDIA: From safeguarding domestic power grids from cyberattacks to mitigating the impacts of a changing climate on military bases overseas, this panel will explore strategies for protecting military and civilian energy infrastructure against kinetic, environmental, and cyber threats. Experts will highlight the vital role of resilient energy systems and infrastructure in maintaining operational readiness and strengthening national security amid a rapidly evolving global threat landscape.

The selected stories cover a broad array of cyber threats and are intended to aid readers in framing key publicly discussed threats and overall situational awareness. InfoDom Securities does not endorse any third-party claims made in its original material or related links on its sites; the opinions expressed by third parties are theirs alone. For further questions, please contact InfoDom Securities at dominanceinformation@gmail.com.The selected stories cover a broad array of cyber threats and are intended to aid readers in framing key publicly discussed threats and overall situational awareness. InfoDom Securities does not endorse any third-party claims made in its original material or related links on its sites; the opinions expressed by third parties are theirs alone. For further questions, please contact InfoDom Securities at dominanceinformation@gmail.com.